Five Ways to Grow Your Company Without Investors

Several years ago, I discovered that the overwhelming majority of fast-growing companies (like those listed on the INC. 5000 list in the USA or the FastTrack 100 where I work in the UK) have never taken any outside investment.

How then, I wondered, did they get their hands on the cash they needed to grow?

Several years ago, I discovered that the overwhelming majority of fast-growing companies, like those listed on the INC. 5000 list in the USA or the FastTrack 100 where I work in the UK, have never taken any outside investment.

How then, I wondered, did they get their hands on the cash they needed to grow?

As a three-time entrepreneur with a win, a loss, and a draw to my name, and now as a professor at one of the world’s leading business schools, I’ve spent the second half of my career helping, encouraging, and inspiring mid-market entrepreneurs to put tools into their toolkits to enable them to grow their businesses faster and with greater success.

It’s important that they – and you! – do so, as nearly all of the net new jobs in any economy are generated not by large multinational companies (most of which are busy trying to substitute capital for labor, to keep their costs down). And not by startups, either, as for every startup that gains some traction there’s another one down the street that’s struggling to survive.

So who creates the jobs that so many societies need these days? It’s mid-market entrepreneurs who find ways to grow their businesses rapidly. Gazelles, as they’re sometimes called. But there’s a catch. As my good friend Verne Harnish says, “Growth sucks cash.”

In fact, as I tell the mid-market entrepreneurs I work with, it’s most often the case that “Growth eats cash – for breakfast, lunch, and dinner.”

So where, pray tell, might you as a founder or CEO of a mid-market business find the cash you need to become a gazelle? You might think the answer is to go raise some investment capital, which in my experience is both more difficult and less pleasant (later on, once the honeymoon is over) than it looks.

And the evidence from the tables of fast-growing companies corroborated that investors weren’t the answer, either. So, what might you do, I wondered back in 2012, as I embarked on a program of research to address this time-honored challenge.

Might the answer be the customer, I wondered.

My research partner and former student (and an inspiring entrepreneur in her own right), Nell Derick-Debevoise, and I began searching for companies that appeared to get their start or grow with their customers’ funds.

.jpg?width=321&name=5models_quote01%20(1).jpg) As it turns out, growing a business using customer funds is nothing new.

As it turns out, growing a business using customer funds is nothing new.

Further, as we discovered, it’s a very smart way to grow and prove – to yourself and to others – that your business will be sustainable.

In fact, it’s always been smart, but no one talks about it these days, given all the hype about the wonders of venture capital. Why smart? After all, at the heart of any business is the customer. If there’s no paying customer — at least eventually — there’s no business either.

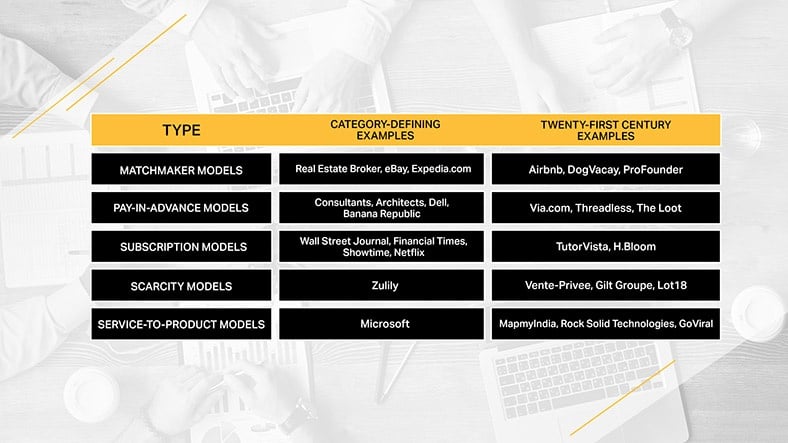

To make a long story short, Nell and I discovered that there are five – not six, not four – yes, five types of customer-funded models that enable gazelles all over the world to grow with their customers’ funding.

In this article, I’ll briefly describe and provide examples of each of the five types. Then, in a series of subsequent articles, I’ll dig deeper into the details of each of them – what works, and what doesn’t; possibilities and pitfalls. Are you ready? Here we go!

1) Matchmaker Models

Matchmaker models are those in which the business, with no or limited investment up front, brings together buyers and sellers — without actually owning what is bought and sold — and completes the transaction, earning fees or commissions for doing so.

Matchmaker models have become especially popular as companies have discovered the power of “collaborative consumption” — the sharing of underutilized resources, a practice that’s increasingly promoted and coordinated by web apps and social media.

Well-known companies like eBay, Airbnb, and many more, as well as lesser-known ones like the UK’s Zopa (the peer-to-peer lending site), and even a pet sitting company called DogVacay have all started or grown their companies by bringing together buyers and sellers, thereby reducing their financing needs.

However, not all attempts with matchmaker models have been successful. A classic example of a matchmaker business that has struggled is Groupon.

Benefits Of A Matchmaker Model

- Matchmaker models can grow with virtually no capital injections required.

- You don’t have to tie up your cash in inventory because you don’t actually own any of the goods you’re selling.

- If the matchmaker model you expand into is online, then it’s both easy and inexpensive to set up a simple website and get rolling.

Case Study Of A Matchmaker Model: Airbnb

For Airbnb, the initial investment in 2007 was for a couple of air mattresses on the founders’ San Francisco apartment floor.

By narrowly focusing on large-scale conventions that were too big for the city’s hotel inventory, Brian Chesky and Joe Gebbia built their business one step at a time until they got noticed at the Democratic National Convention in Denver in 2008.

VC funding followed, and the rest is history: some two million properties for rent in more than 200 countries!

2) Pay-In-Advance Models

Pay-in-advance models are those in which the customer pays, partially or in total, before they receive the product or service.

Virtually all services businesses get started this way, and many of them continue to grow this way, too.

But it can work for goods, as well. Michael Dell did this to start his eponymous company from his University of Texas dormitory room, and he continued to grow his business this way, too.

Benefits Of A Pay-In-Advance Model

- Evidence of proof of concept when one or more persons pay you for your service.

- Similarly, if you can’t find a single person to pay you, then perhaps it wasn’t a great idea to begin with, or that it might need more work. If you are launching a new product, it’s better to know this upfront, than later.

- All you need is the order and an initial payment, and you’re off to the races!

Case Study Of A Pay-in-Advance Model: Costco

Most mid-market entrepreneurs in the USA and the UK and their families shop at Costco, and they pay for the privilege of doing so.

Why? They’ve discovered that the $50 or £40 membership fee they pay each year not only gets them access to Costco’s low prices on everyday staples like the world’s largest multi-packs of peanut butter for their teenage kinds. The membership fee also admits them to the treasure hunt that Costco delivers week-in and week-out. From deals on new big-screen TVs to live Maine lobsters, there’s always something unexpected as Costco.

What’s even more unexpected, however, is what its pay-in-advance model does for Costco.

In most years, the sum of everyone’s membership payments adds up to about two thirds of Costco’s operating profit. It’s no wonder that Costco can price its wares far lower than its competitors can. Even better, the cash a newly opened Costco store generates on day one is typically sufficient to open three more stores!

3) Subscription Models

![]() In subscription models, the customer agrees to buy something that is delivered repeatedly over an extended period of time, such as newspapers, a box of organic veggies delivered weekly or a service like a cable TV or your monthly Netflix fix.

In subscription models, the customer agrees to buy something that is delivered repeatedly over an extended period of time, such as newspapers, a box of organic veggies delivered weekly or a service like a cable TV or your monthly Netflix fix.

Subscription models give mid-market CEOs the peace of mind that you’ll have recurring revenue, and thus, freedom.

After all, the best source of freedom — even better than cash in the bank — is positive cash flow!

Benefits Of A Subscription Model

- Predictable revenue when a customer subscribes.

- Reduced revenue risk

- Enhanced company valuation if you wish to sell at some point.

Case Study Of A Subscription Model: TutorVista

Krishnan Ganesh started TutorVista with three Indian teachers and a VoIP internet connection to reach American teens who needed help with their homework.

He quickly learned that $100 per month for “all you can learn” — paid monthly in advance — was just what the teens’ parents wanted.

When renewal rates after the trial subscriptions quickly materialized at north of 50 percent, Ganesh knew he had a viable business, and he realized that scaling the business was simply a matter of adding more fuel. VC funds provided it, and Ganesh sold the business to Pearson in six short years for more than $200 million.

TutorVista’s subscription model has been key to its growth. Because customers pay a predictable monthly fee in advance, the business is highly capital-efficient, and it enjoys smoother revenue growth than most mid-market companies do.

TutorVista is an example of a subscription-based company operating in a space that doesn’t typically rely on subscriptions.

4) Scarcity Models

In the scarcity model, what’s for sale is restricted by the seller to a limited quantity for a limited time period.

Spain’s Zara has become a global fashion leader by doing exactly that.

Many mid-market companies employ such principles, too. Less becomes more!

Zara’s fashionista customers love the fact that a new dress they find at Zara is unlikely to be seen on anyone else. And Zara has trained them that, if they see something they like, they’d better buy it now. “When it’s gone, it’s gone.”

The result? Zara is able to turn its inventory around 12 times per year, so its 60-day terms with its suppliers mean that the goods have typically been sold before they’ve been paid for!

What does Zara do with all that cash? It grows, then grows some more.

Benefits Of A Scarcity Model

- Motivates customers to “buy now”

- The allure of limited editions or a limited time to purchase items can create super fans and form a distinct brand for your company.

- Creates negative net working capital to fuel growth

Case Study Of A Failed Scarcity Model:

Gilt Groupe

Scarcity models are tricky to get right, and not all scarcity models have worked out.

The flash sales industry provides a prominent example. In mid-2007 in New York, serial entrepreneur Kevin Ryan observed what was happening in Paris with Vente-Privee, the originator of the flash sales concept.

The flash sales idea was a simple one. Buy some closeout fashion merchandise on 60- or 90-day terms. Produce a classy promotional video and run a three-day sale event online with deeply discounted prices. Customers pay with their credit cards. Use the ‘float’ before the vendor is paid to run more events.

Looks easy, right?

Ryan founded Gilt Groupe with two style-conscious Harvard Business School MBA graduates who brought experience from designer brands Louis Vuitton and Bulgari, along with some other useful vendor relationships. With the world in the throes of the global financial crisis, fashion apparel makers had plenty of overstocks and were eager to get rid of them.

A few years later, however, the flash sales phenomenon lost its luster, as the apparel makers got their inventories back in order. With too many VC-fueled flash sales merchants asking for their closeouts, they did three things.

They raised the prices, cut back on quality, and even made goods specifically for the flash sales merchants.

The value disappeared, and so, too, did many of the flash sales merchants!

5) Service-To-Product Models

A wonderful thing about most services businesses is that they require little or no cash to get started. Microsoft is an example.

But growing a services business is much more difficult, as winning more business typically means hiring more service providers to deliver. Scale is tough to achieve.

Service-to-product models are those in which a service provider transforms the service it’s been providing into a product that can be sold without all the handholding and customization that many services require.

Bill Gates and Paul Allen transformed Microsoft from a services business that wrote operating systems for early PC makers into a product business that sold software — MS-DOS, Word, Excel and more — in shrink-wrapped boxes or downloaded digitally.

That’s when the value of Microsoft really took off.

Benefits Of A Service-To-Product Model

- Potentially more scalable than a services business

Case Study Of A Service-To-Product Model: GoViral

Danish entrepreneurs Claus Moseholm and Balder Olrik founded GoViral, a Danish company in 2003 to harness the then-emerging power of the internet to deliver advertisers’ video content in viral fashion.

In 277, Jimmy Maymann joined Go Viral and saw the potential to transform it from a mid-sized creator of viral video content into a product platform that would host and distribute viral content for advertising agencies and other creators.

The service-to-product transformation worked, and in 2011, GoViral was sold for $97 million, having never taken a single kronor of investment capital.

Just what Bill Gates and Paul Allen had done decades earlier, with their transition from writing operating systems for early PC makers into selling application software in shrink-wrapped boxes!

Customer-Funded Models In Action

These five customer-funded models are nothing new, but they’ve been proven to work over time. They haven’t just worked for the early pioneers of these models; they continue to work for many companies in the 21st century. Perhaps yours!

Here’s a glimpse into just some of the companies which have put these customer-funded models to work, some successfully, some not.

Common Factors And a Way Forward

.jpg?width=300&name=5models_quote03%20(1).jpg) Regardless of their type or the eventual size to which they have grown, companies using customer-funded models share three attributes:

Regardless of their type or the eventual size to which they have grown, companies using customer-funded models share three attributes:

- They typically required little or no external capital to get started.

- Their balance sheets contain negative working capital. They love the float!

- When some elect to raise capital to grow even faster, they find an eager queue of investors lining up at their door. Investors love capital-efficient businesses!

Whichever model you choose, a customer-funded approach offers you all these advantages and more.

So if you’re a mid-market business owner trying to increase your cash flow and expand, one of these customer-funded models may offer the most sure-footed path to growing your business.

If you want to grow your mid-market business, read on!

But don’t just take it from me. In the words of one of Shanghai’s leading business owners and angel investors Bernard Auyang, “The customer is not just king, he can be your VC too!”

.png?width=529&name=3%20(1).png)