How to Secure Recurring Revenue for Your Mid-Market Business

For many of us, subscriptions are something we rarely pay attention to but benefit from every day.

We have Netflix and Audible, and many of our newspapers, magazines, cell phones and TV programming are purchased by subscription.

The gas and electric utilities that heat and light our homes come that way, too. Even organic vegetables, in some places, arrive to our doorstep each week by subscription.

One of the biggest benefits these businesses enjoy is predictable cash flow when a customer subscribes.

Wouldn’t you like your mid-market business to generate cash flow while you sleep? Wouldn’t it be nice for your customers to give you cash now for goods or services that you don’t have to deliver until later?

In this article, we’ll look into the features that support a subscription model and how subscription models have been applied in some surprising settings. Perhaps you can apply such a model in yours! We’ll also explore why some subscription-based businesses have stumbled.

The Three Key Features That Support Subscription Models

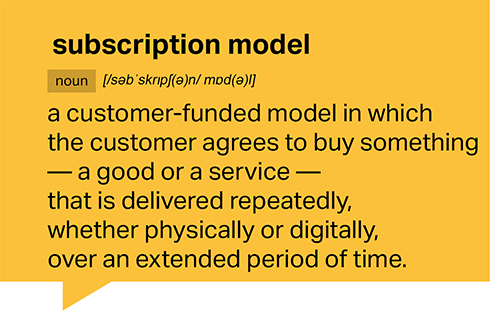

First, let’s briefly cover the key features of products or services that are best suited for a subscription model.

- Perishable

Yesterday’s news. Organic veggies. When the product or service loses value over time, a subscription model is a good way to ensure that the value is refreshed automatically, without missing a beat. - Predictably and reliably consumed

The product or service people subscribe to is something the customer wants or needs in a regular and predictable way. Razor blades, for example, are used – and used up – on a daily basis. - Convenience matters to the customer

If a customer uses the product or service regularly, they would rather pay to guarantee regular product delivery or access to the service instead of dealing with the inconvenience of having to remember to get it or making a special trip to get it. - And, as always, the subscription must provide good value, too.

Now that we’ve covered the basics of what makes subscription models effective, let’s look into some interesting ways subscription models, which give seller the customer’s cash up front, have been applied to create fast-growing businesses.

Subscription Models for Software: SaaS

Rather than buying software in a shrink-wrapped box or downloading it, it’s become commonplace to simply subscribe to the software we need. This model is known as ‘software as a service’, or SaaS for short.

Salesforce.com was an early SaaS pioneer. In 2012, their software subscription revenue reached $56 billion in the United States alone.

There are a few reasons the SaaS model works so well for users. These include:

- Users will always be running the latest version so they never have to worry about outdated features.

- It often requires a much smaller upfront cost than buying a similar software outright.

- A user often enjoys the additional value of unlimited online support as part of the deal.

Software companies that switch to SaaS models like them, too, as they benefit from predictable and recurring revenue, so their founders sleep better at night! It typically costs them less to support and market their software through the cloud than by other means, too.

Even Microsoft, the longtime leader in selling shrink-wrapped or downloaded software the old-fashioned way, began adopting a SaaS model when they introduced a subscription-based Office Home Premium product in March 2013. At a subscription price of $100 per year, it’s become Microsoft’s fastest product ever to hit an annual revenue of $1 billion.

If you are a mid-market software company, SaaS models must be at the center of your strategic thinking.

If you don’t have an attractively priced SaaS offering, one of your competitors surely soon will.

Educating the World through Subscription: TutorVista

Conventional models of education are usually based on a fixed fee for a certain number of classes, such as fixed semester fees or hourly charges for tuition. TutorVista broke this convention by applying a subscription model in a novel way.

The idea for TutorVista was conceived when Krishnan Ganesh was traveling in the United States in early 2005.

During his visit, he was shocked by the amount of media debate over student performance in the U.S. education system.

Ganesh started TutorVista with three Indian teachers to help American teens who needed help with their homework. Sessions were conducted with a headset and webcam at each end, a VoIP connection, and an “erasable whiteboard” on their computer screens on which both teacher and student could write — one in red, the other in blue.

When TutorVista started, it followed the conventional hourly rate model.

When TutorVista started, it followed the conventional hourly rate model.

Knowing that face-to-face tutoring in the United States was usually priced at $60 per hour, Ganesh priced his offering at $20 per hour.

After running the business on hourly rates for a short time, Ganesh discovered that parents preferred a subscription of $100 per month for an “all you can learn” model.

Paid in advance every month, students could receive all the tutoring they wanted, 24/7. When TutorVista switched to the subscription model, they enhanced customer adoption and retention, AND their cash flow.

TutorVista’s subscription model became key to its growth. When renewal rates after the trial subscriptions quickly materialized north of 50 percent, growing the business even faster was simply a matter of adding more fuel. VC funds provided it, and Ganesh sold the business to Pearson in six short years for more than $200 million.

While its customer-funded subscription model was not responsible for TutorVista’s entire journey, it did give the company a fast-growing start and a capital-efficient model that its investors loved.

Launching A Startup With Customer Funding

In July 2009, Sam Pollaro and his wife, Sarah, launched their site, PetalsForThePeople.com, having spent practically no money — just a couple of thousand dollars on a graphic designer and some printed materials.

Their customers’ cash would fund the rest of their journey through the subscription model.

For a weekly or biweekly subscription, consumers could collect a small bundle of flowers or have it delivered. Sarah, who had previously run a small floral design business, would then upload a tutorial video showing customers how to arrange the flowers selected for that week.

Customers would simply log into their online members’ area to view the video.

Unlike a local florist, who never really knew what demand would be like from one day to the next, the Pollaros would know exactly how many subscribers they had and therefore could provide their customers with flowers that were truly fresh.

Unlike a local florist, who never really knew what demand would be like from one day to the next, the Pollaros would know exactly how many subscribers they had and therefore could provide their customers with flowers that were truly fresh.

Since customers were arranging the flowers themselves, they could also provide these flowers at a very affordable price — the cost of several weeks of subscription was equal to about the price of a single high-end delivered bouquet.

By June 2010, the couple had acquired a few hundred subscribers and was running smoothly on cruise control. Employees were packing and delivering flowers like clockwork. The company was still relatively small, however. That was when Bryan Burkhart came into the picture.

Replicating the Success of a Proven Subscription Model – Or Not!

Software sales executive Bryan Burkhart was looking for a new business idea.

He became interested in floral businesses when he discovered that the flower industry was worth a massive $35 billion dollars annually in the United States alone.

Not knowing anything about flowers, he began meeting with florists to learn more. What he discovered was many flaws in the typical retail florist’s business model, from unnecessary storefronts to extensive spoilage and the considerable markup needed to cover these costs.

Burkhart met Sarah Pollaro through the introduction of a mutual acquaintance and had an epiphany to replicate and grow her subscription-based model for flowers.

H.Bloom, a service that offered flower subscriptions primarily to corporate customers, was born.

Since Burkhart had experience raising money from investors, he was able to raise $1.1 million in seed funding. Positioning H.Bloom as “the Netflix of flowers”, the new company enabled customers to sign up for luxurious flowers with convenient delivery at really affordable prices, beautifully arranged and delivered automatically.

But Burkhart, who had already tasted the VC Kool-Aid in his previous job, didn’t fully understand the key benefits that a subscription model brings.

But Burkhart, who had already tasted the VC Kool-Aid in his previous job, didn’t fully understand the key benefits that a subscription model brings.

A customer-funded subscription model can inherently grow, as the Pollaros had discovered, but not always very fast. He wanted to grow fast, to 25 US cities within two years.

Burkhart convinced investors that their capital married with a tech-enabled business could reinvent the stone-age retail flower industry.

Alas, H.Bloom over-expanded, and belatedly discovered that the traditional floral providers were already serving corporate customers with subscription models of their own. VCs stopped funding the company and its growth came to a screeching halt.

Thanks to its subscription model that always provides it with sufficient customer cash to keep it afloat, however, the company has survived as one more independent provider of floral arrangements for offices, hotels, and other kinds of clients.

Why Some Companies Struggle with Subscription Models

As we’ve seen, not every company has succeeded with a subscription model. Those that struggle often fail because their offer did not meet the features that support a subscription model mentioned at the beginning of this article:

- Perishable

- Predictably and reliably consumed

- Convenience matters

- Good value, too

-1.png?width=500&name=2%20(1)-1.png)

Manpacks.com is one company that did not do well with the subscription model. They delivered socks, underwear, and other men’s essentials such as cologne on a quarterly subscription basis.

But, unlike flowers and organic vegetables that perish, my underwear lasts for a very long time! And cologne doesn’t have a predictable usage.

So there was never a need to have a regular stream of underwear or cologne delivered. Just like any business, if what’s offered fails to satisfy its target market’s need – or there’s no need at all – the business is unlikely to work!

It’s the same for shoes. When reality-TV-star Kim Kardashian launched ShoeDazzle, a subscription service that offered a new pair of shoes each month, she was able to attract millions of VC funding.

Due to her celebrity status, ShoeDazzle initially rocketed to a large number of early subscribers and impressive sales numbers. But do women, even shoe addicts, really need a monthly subscription for shoes?

It soon became apparent that there wasn’t enough demand for a regular supply of shoes. After a mere three years in business, ShoeDazzle’s novelty wore off and ShoeDazzle junked its subscription model.

A Success Checklist For Subscription Models

To determine whether something your mid-market company sells could be successfully offered via a subscription model, ask yourself three questions:

- Do I offer something that’s perishable that my customers would rather have today than tomorrow or next week?

- Is there something in my product line that’s predictably and reliably consumed?

- Would a subscription model deliver more convenience to some target market than my current offer?

- And, as always, can I price a subscription model profitably for me and still give good value to my customer?

HP now sells me ink cartridges for my ink-jet printer on a subscription basis, so I don’t have to bother with regular trips to the office superstore. Cutting out the retail middleman gives HP better gross margins, too.

Microsoft sells MS Office to my employer on a subscription basis, so I never have to worry about updates. The Economist renews my subscription automatically each year, so I don’t have to worry about missing any issues.

If you can do likewise, there is a really good chance you can use a subscription model to grow your business faster than it’s growing today!

If you'd like to build out your own customer-funded business, be sure to check out the program, Scaling Your Company Without Venture Capital - Master Business Course.