5 Keys To Conquer The Chaos & Implement Your Business Survival Toolkit

After 20 years as a CEO, I understand the drama that 2020 brought to the business community. I endured my first such crisis as CEO of an internet company in 2001—when the internet bubble burst. It was a tough time, but it wasn’t the only tough time I’ve survived. It seems that every eight or so years, we endure some sort of financial crisis and ensuing drama in the U.S.

At this moment, we’re in the middle of a tsunami. A tsunami starts as an earthquake under the ocean. Several hours later, a huge wave crashes onto land. That’s where we are. The earthquake has happened, and we’re on the beach expecting a devastating wave. But when will it hit?

The 2008 real estate crisis may be a good indicator. It took three years from the first subprime mortgage bank failure in April 2007 until the U.S. real estate market bottomed out in February 2010. Three years!

If we view the COVID-19 pandemic through that lens, we still have a ways to go. The pandemic hit the U.S. in March 2020. Businesses got government support and used their savings, but now money is running out. We’re entering a new phase, but the crisis is far from over.

There’s no doubt that 2021 will be a challenging year. How can you prepare your company now to survive the instability ahead?

A mentor of mine taught me to think of a crisis like a forest fire. When you picture a forest, you see beautiful, big trees. But beneath them, weeds and small plants grow, taking water and nutrients that prevent the trees from reaching their full potential. When a fire burns through, it kills all of the underbrush but only some of the big trees—mostly the weak or sick ones. The healthiest trees survive, and they come out far stronger because the ashes create more nutritious soil.

That’s how economies are, too. In a strong economy, we overproduce companies, overheat markets, and some companies achieve crazy valuations, even if they’re not providing value. Maybe they’re poorly run or artificially maintained by investor money. But they’re not doing the hard work to create real value, so when a crisis sweeps through, they probably won’t survive—just like those weak trees.

If you run a company, what can you do to ensure its survival when a crisis erupts? That’s exactly the position Growth Institute found itself in. I’ll share how we survived and positioned our company for growth despite uncertainty.

During a recession, the key is to go back to basics. You need to identify the precise value your company provides, stay aware of trends, sharpen leadership skills, and up your game to become a better leader.

As my friend Dan Martell says: “Panic is contagious. But so is leadership. It’s time to rise up as leaders.”

Here’s how we used the Scaling Up tools to survive the first phase of this crisis, and how we plan to thrive going forward.

Double down on Scaling Up

When the U.S. went into lockdown in March 2020, our company lost 90% of its revenue in a week. In response, I did a deep dive into the financial crises of 2000 and 2008, looking for trends to figure out 2020.

I concluded that we had to double down on Scaling Up. We needed to increase discipline, focus, and leadership in order to survive.

To focus your team and give them the tools to be effective, you have to change your mindset, change your words, and become a better leader. Being more effective as a team delivers the confidence to come out of this better. Leadership is contagious!

The four decisions

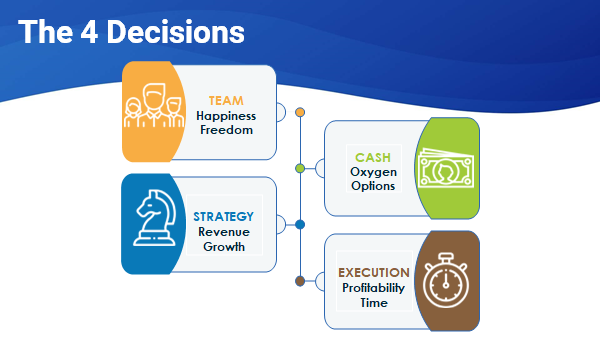

The four decisions that successful business leaders live by are team, strategy, cash, and execution:

Team. The right team gives you happiness and freedom. You have fun together. And if you need to step away, your A Team can keep your company running.

Strategy. If you have the right strategy, it’s reflected in your growth and revenue. If revenue isn’t growing as it should, you don’t have the right strategy.

Execution is reflected in both profitability and how much time it takes you to run your company. If you’re working 15-hour days, you have an execution problem.

Cash gives your company oxygen and options. Insufficient cash is a symptom, like when you have a fever. The fever itself isn’t the problem; it’s a symptom of another illness. If you have a cash problem, it’s a symptom of a strategy, execution, or team problem. Diagnose what’s creating that problem, then attack it.

To better control your company, I’ll share the five keys that allow you to conquer the chaos and scale up.

The five keys

When entrepreneurs ask me how to react to the economic recession or pandemic, here’s what I tell them: You can’t control outside forces, so don’t focus on them.

Instead, focus on what you can control to make your business strong. Tighten the reins so you can control how your company moves in the market. Then, no matter what happens, you’ll be positioned to adapt and succeed.

When you follow these five keys to recession-proof your business, no matter what happens, you’re going to be successful next year:

1. Survive first, then 2X

Plan A: Survive. When the pandemic hit, I spent an entire weekend on research and strategy. That next Monday morning, I told my team that we would spend the next three months doing whatever it took to survive. After that, we would adapt our mindset and double our revenue.

Plan B: Build your 2x model. We knew a lot of companies would go under. Our job was to survive, then take advantage of new opportunities to grow. It gave the team confidence to know we had a plan, understood what was happening, and knew how to react.

One Scaling Up tool we used during survival mode is the Strengths, Weaknesses, and Trends (SWT) analysis. We asked two questions:

- What’s going to change in the future?

- More importantly: What is not going to change in the future?

What was not going to change was that CEOs need training to scale and grow. What was going to change was how we delivered that training.

We established our SWT and then used the One Page Strategic Plan (OPSP) to adapt our strategy. We scratched out short-term plans but kept most of our long-term strategy. It took about three weeks to adjust our OPSP, and then we started executing.

Case Study

One of our April 2020 Scaling Up students shared her experience on strategy:

“We had a breakthrough in every pillar of Scaling Up. On strategy, when the pandemic hit, we were a hospitality business, and we were able to pivot to become a wellness company. With this shift, we’re now looking at e-commerce opportunities and expanding our services.”

― Sharmilee Agarwal Kapur, Co-founder and Director, Atmantan Wellness Center

The market changes, the industry changes, everything changes―but you can still serve your clients. It’s critical to understand precisely what you provide that adds value to the world.

Then, you can adapt to how people want to receive that value.

That’s how you survive.

2. Implement communications rhythms

When a crisis hits, it’s critical to move quickly and over-communicate.

We have a daily huddle at 8:07 am. When COVID hit, we added a second daily huddle at 4:47 pm. Team members told us that it was reassuring to see us and hear that we were focused on survival and serving clients.

Our communication rhythm raised confidence and helped us move way faster. In times of stress, double down on your communication and contact with other people.

We recommend the following meeting rhythm:

Daily huddle: A quick synchronization where you share good news and brief updates. Find out where team members are stuck and help them get unstuck.

Weekly meeting: Define actions and communications. Focus on what you’ll deliver this week.

Monthly meeting: A strategic discussion to plan a major opportunity or solve a significant problem.

Quarterly meeting: Define theme and alignment, pinpoint desired objectives, priorities, and results.

Don’t break this rhythm. In crisis, we tend to lose our rhythms. That’s one thing that will keep you strong whenever something goes wrong. Double down on meetings, give your cadence a rhythm, and you’ll provide stability to your team.

Case Study

An April 2020 Scaling Up student learned the importance of consistent meetings:

“I manage sales. My daily huddle is directly linked to the weekly sales meetings, whereby I monitor the status of sales the team said they would close during the week. As for the weekly meeting, we previously were not consistent but have now entered a fixed, recurring time in the calendar for regular meetings. Now that we’re consistent, we don’t have surprises every week.”

― Tini Meyer, Managing Partner, Interior 360

3. Double down on data

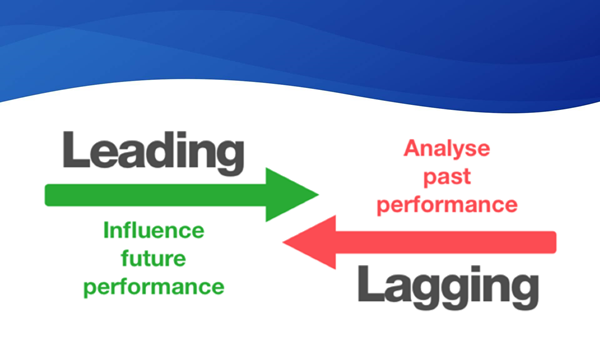

Do you base your company’s next move on lagging or leading indicators? Lagging indicators analyze past performance. Leading indicators inform future performance.

Most business data is collected from the past and is, therefore, a lagging indicator. Imagine driving a car while looking through the rearview mirror. Similarly, with lagging indicators, you can’t see through the problem to what lies ahead.

In response to the crisis, we aligned the team toward our purpose so that we were clear on why we needed to survive. The next step was to link that purpose to each person, making them accountable with clear key performance indicators (KPIs).

Dashboards aggregate data to reveal what’s going on in your company. We use two dashboards. In one, we doubled down on forward-looking KPIs—leading indicators—to see where things are headed everyday. Our second dashboard focuses on past, backward-looking KPIs to understand how we are progressing toward our quarterly and annual goals.

Armed with both lagging and leading data, we’re aware of past trends and know where our company is headed.

Case Study

Here’s what Scaling Up students discovered about the importance of KPIs:

“We created a comprehensive list of two or three KPIs for every employee and then converted them into a team dashboard. We see our progress every morning, and we can confirm if we are having a good day, month and quarter.” ― Samuel Herre, Managing Director, Interior 360

Imagine having data that proves you’re having a good day. It enables you to have better control and react much faster.

“We have total alignment of the team towards our purpose, including clear communication channels. We linked each function to a person who would be accountable with clear KPIs. Then we reviewed key processes to ensure these were clearly documented.” ― Ashif Kassam, Executive Chairman, RSM Eastern Africa

4. Dominate your expenses

Remember this truth: You can control expenses, but you cannot control income. You can implement a great strategy and make every effort to achieve KPIs that drive revenue, but the final decision is the client’s, not yours.

With expenses, you have 100% control. That’s where you must focus to survive. But even with controlled expenses, cash flow ups-and-downs can make paying fixed expenses a challenge.

That’s why it’s essential to convert some of your vendor expenses to variable expenses. With a variable agreement, if you have a poor month, everyone makes less money, but you pay them more when you have a great month.

Students told me that suppliers wouldn’t accept variable contracts. But when the crisis hit, Growth Institute met with all suppliers and gave them two options: Either work with us on a variable basis, or we’ll cancel the contract.

Many agreed to our request because they would rather make less in lean months than have us go out of business altogether.

Now is the ideal time to negotiate variable contracts. Everyone knows the economy could get worse. Explain to your suppliers that if the company goes under, you both lose. It’s better for everyone to stay alive in the same boat.

Negotiating contracts is part of doing business. To make sure your company survives, have those uncomfortable conversations with suppliers. They may not be happy to hear it, but they will appreciate your candor―and those who stay with you do so because they want to work with you.

Case Study

Here’s what a Scaling Up student learned about expenses:

“With the pandemic, we were hit by a 30% revenue decrease versus 2019. We decided to focus on securing cash by controlling expenses and raising financing. Thanks to this, we were able to secure almost one year of cash.”

― Felix Robitaille, CEO, XRM Vision

A year of cash in the bank? Imagine how well you’ll sleep with one year of fixed expenses in the bank. How can you achieve that feat?

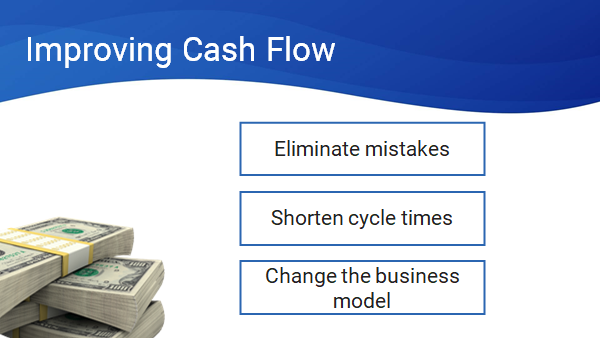

Start by understanding cash conversion cycles: When you invest a dollar in serving a client, how long is it before that dollar comes back as profit? Unfortunately, the faster you grow, the more cycles you’ll have, and the slower they are. Consider your sales cycle, production and inventory cycle, delivery cycle, and billing and payment cycles.

To improve cash flow, ask yourself how to:

- Eliminate mistakes

- Shorten cycle times

- Change the business model to improve your cycles

With a cash acceleration strategy and variable expense agreements, you’ll dominate your expenses and gain better control of your business.

With a cash acceleration strategy and variable expense agreements, you’ll dominate your expenses and gain better control of your business.

5. Bet on your A Team

When the crisis hit, I knew I needed my A Team to drive growth. I wanted to make sure I knew who my A Players were. I used the Functional Accountability Chart (FACe) tool. It’s very helpful in identifying the essential A Players in each area of your company, what they’re accountable for, and whether they’re critical to your company’s survival.

I analyzed every team member and cleaned house. We have 25% fewer team members today than we did in 2019. The people who stayed were engaged and optimistic. They knew our team would execute better and had a higher chance of staying alive.

Once again, it’s like a forest fire: Those who remain grow stronger. The FACe tool provides the framework and asks the right questions to identify your A Team so you can double down and grow.

Case Studies

Here’s what Scaling Up students learned using this critical tool:

“The FACe tool exposed the imbalance of our team members. We now have it broken down so that almost every function has a single responsible party, and each party is only responsible for that function.” ― Greg Maciulla, Construction Operations Manager, Triple Crown Construction

“One of the first questions our Scaling Up coach raised was, ‘Would you enthusiastically rehire everyone on your team again?’ We immediately let go of the people who didn’t make the cut. The energy of the team improved straight away.” ― Jurgen Herre, Managing Partner, Interior 360

We expect 2021 to be another difficult year, but with the tools and coaching of the Scaling Up Master Business Course, you will survive, grow stronger, and thrive.

What makes the Scaling Up Master Business Course different?

We provide you with live coaching, video modules, peer support, and mastermind groups to ensure you have everything you need to implement Scaling Up.

When you join our upcoming class, you will be in the first cohort to benefit from the fresh, new content Verne Harnish recorded in September.

Imagine how much freedom you’ll enjoy when you, like the students from our case studies, implement the Scaling Up methodology in your company: You’ll make intentional changes toward 2X growth by establishing communications rhythms, doubling down on data, dominating expenses, and ensuring your A Team has the tools to focus on growth rather than the uncertainty of the situation unfolding around us.

Remember: Panic is contagious, but so is leadership. When your team sees that you’re in control and feeling good about the future, it will give them the confidence to execute flawlessly—and give you the freedom to enjoy the journey!