How To Turn Your Company And Team Into a Cash Flow Positive Machine

Let's assume that you know your 4 Chapters and you understand your cash flow. The next thing to decide is, How do you improve the business?

You do that with The Power of One. The Power of One enables you and your management team to control your numbers with ease and simplicity.

It's a powerful tool. But even more dramatic changes are possible when you get everyone loving the numbers and committing to building a cash flow positive business.

Here's how to set that foundation in place.

Lead Your Business With No Surprises

Verne Harnish has a saying about the traits of a good leader.

A good leader haves:

- The ability to predict

- The ability to delegate

- The ability to repeat, repeat, repeat

I want to emphasize this ability to repeat, repeat, repeat. You want to build this muscle of understanding your financial story consistently throughout your company. That's how you can predict and make better, optimized decisions.

When my CPA partners and I were first starting our company, we didn't have any funding. Eventually, one of Australia's wealthy families saw our value and backed us.

On one of our first days as partners, this family sent us an email describing how they prefer to run their companies.

They listed several "rules" that they preferred to live by with running their companies:

- Two heads are better than one

- Everyone has the right to be heard in a non-threatening way

- The truth will be told

- Our word is our bond

- The needs of the customer come first

- There will be no surprises - put the uncomfortable issues on the table

- Promote teamwork and leadership

- Be proactive corporate citizens

After working with so many businesses over the years, it's the concept of no surprises that most resonates with me. Let's hear the bad news, bring two heads together (because that's better than one), and let's solve these problems in a non-threatening way.

The objective of managing your cash, your profit, and your value is to eliminate your financial blind spots.

Understand and Own All Of Your 4 Decisions

Cash is just one crucial piece of your 4 Decisions to scale.

If I'm evaluating your business, I still want to know that you are making good People decisions. Do you have the right people on the bus? Do you have your team of A-Players? Are your A-Players happy, challenged, and winning?

I also want to know if your strategy is working. And I want to know that your Execution is working. Are you converting your bottom line into profit? And cash is simple. Is your bank account growing?

All 4 Decisions are linked. If you don't have cash, you won't be able to implement your strategy. So it's critical that you can see these 4 Decisions as an integrated solution.

Everyone Needs To Know The Score

You would not believe how many businesses I walk into where the accounting department works in a silo. The accountant sits in the office, reporting the numbers and doing a great job.

But that's not enough. You want to make sure that everyone in your team understands the numbers. The numbers need to be recorded by everyone in your management team - marketing, product, operations, etc.

Many of the financial meetings I see are focused on micro-decisions. (i.e., How did our travel expenditures change month-over-month?)

But you want to understand your numbers in terms of what strategic changes you can make to improve your profit, cash & value. You want to focus on the big picture on your screen and not on the individual dots on it.

You've got to know the score, and you've got to teach your non-financial people the score.

These are the numbers everyone on your leadership team should know:

- Your margins

- Your profit

- Your accounts receivable days

- Your inventory by days

- Your works in progress

- How quickly you pay your suppliers and

- Your cash flow

Your business is no different from a scoring event. There's one score.

Set Up Your 4 Chapter Team And Teach Them The 4 Chapter Story

When I'm looking at the People side of a business, I want to make sure that they have the right people on the bus?

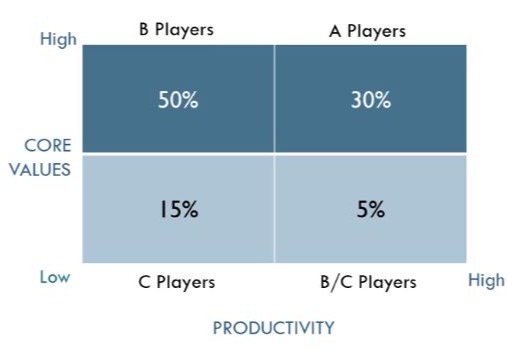

So what do the right people mean? The right people are people who are living your core values and are productive. So by definition, an A-Player is someone who loves your company values and is performing to your KPIs.

A B-Player is a person who is living the values but not as yet productive. Do they have potential, or do you believe they will always remain as a B Player?

A B/C-Player is a dangerous person. These are productive people, but it's all about them. And a C-Player is a person who is not effective and not living your values.

I'm concerned about the retention of A-Players. A-Players are the champions that you don't want to lose. You also need to have techniques to convert your B-Players into A-Players, and what do you need to do to make your C Players into A Players?

Surround your A-Players with other A Players and give them the best opportunity to win.

Your marketing, operations, finance team, and CEO should all be part of a 4 Chapter storytelling team. You cannot have surprises.

A story about numbers is not only about profit. Everyone needs to tell the same logical story of no surprises.

We all want to win. The more we educate our non-financial people, the better the decisions that they will make.

Your team needs how they impact cash flow; they need to become a 4 Chapter team.

Set Up Your 4 Chapter Meeting

Your 4 Chapter team needs to meet quarterly to discuss financial strategy.

The outcome of this 4 Chapter meeting will be that your team learns to love the numbers because they will see how they are impacting the company.

They will also understand the changes they need to make to drive improvement.

Everyone on your team must have a financial understanding of your company to make decisions. But this is often the last part of strategy meetings. It's complicated. No one wants to understand it, and no one wants to discuss it.

As the CEO, your success hinges on your ability to repeat, repeat, repeat. The more often you run these sessions, the more everyone in your management will want to start these meetings with the financial component. They will embrace it. That's the level of understanding that will lead to better decisions and dramatic changes in your growth.

Get Your Strategy Right Align To It

Is your strategy working? If I had to meet you in a room and I said to you, "Tell me your plan." Would every person in your office give me the following same answer?

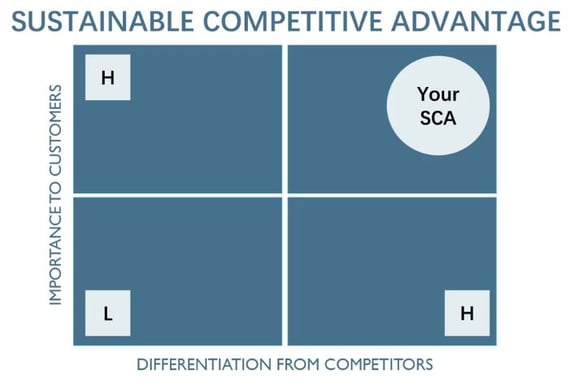

What do you do that makes you essential to the customer, and what are you doing to differentiate yourself from your competitors?

Robert Bloom was integral for the strategy development of Southwest Airlines, an experience he used in writing his book The Insider Advantage, which shares how to discover the critical strategic asset within every business.

He describes that, in every successful company that he meets, people can describe four things:

1. Who

Who is your Core Customer? Who is prepared to pay for your product or service and at your price-point?

2. What

What is the unique offering that you will communicate to your Core Customer who's prepared to pay you superior pricing?

3. How

What is your strategy for communicating this unique offering to your core customer?

4. Own It

And then, finally, to bring them all together, you have to show how you own it. Make sure that what you're doing is helping you own your niche.

Conclusion

With these cultural processes in place, your company will be on track to love and embrace your cash flow numbers.