6 Rules For Executives To Drive Better Cash Flow In The Business

As an entrepreneur, one of the biggest priorities - and headaches - on your plate is figuring out how to effectively increase the value of your business.

Understanding your company’s financials plays a critical role in that priority.

But unnecessarily complicated financial statements have often made it difficult to understand which numbers actually matter in your business.

So I want to leave you with a much simpler way of looking at them.

I want to share 6 big ideas that are key to understanding how your financials impact the bottom line. These ideas are about enabling you and your company to love the numbers, so you can make smart decisions to increase your profit, cash flow and valuation. Here they are.

#1 The #1 Score Of Your Business Is Cash Flow

By trade, I’m a Chartered Accountant.

I’ve worked to simplify the numbers for most of my adult life. This work has taken me to over 96 countries where I’ve helped people, businesses, and banks change the way they look at their financials.

The pattern with entrepreneurs that I have seen time and time again is that they always talk about profit and revenue - but not a word about cash.

When you go to the bank, they’re not worrying about your revenue or profit. They are looking at your capacity to repay your debt, which is cash flow. You also need cash to fund the growth of your business.

What you as the business leader may not realize is that profit and revenue only make up the inputs of your financial story. Those inputs heavily impact your cash flow.

And that’s why I keep saying:

The true result of your business is cash flow.

#2 Managing The Cash Flow In Your Business Is a Game

Your business is a lot like a sporting match.

In this match, the goal of every company is to make more cash.

How your company performs in this game depends on the quality of your team players. As we’ve learned from Verne’s Scaling Up section on People, you will never achieve cash flow excellence without people excellence.

The key to this game is simplicity.

You need to teach your people to play the game of business, which is: “How do we improve our profit, cash flow, and value?”

The Cash Flow Story framework and the Power of One concept are all about getting your people to love the numbers and turning them into A Players. It’s A Players that want to win the game for your business and understand how to improve.

Learn how to easily manage the cash flow in your business and then teach it to your team.

That’s how you get everyone in the company accountable for your growth and valuation.

#3 Don’t Skip Out On Reading Your Balance Sheet

Just about every single business out there focuses on the Income statement. Maybe it’s because it seems a lot easier to read.

Unfortunately, you will never become a storyteller of your company’s finances if you don’t also focus on your balance sheet.

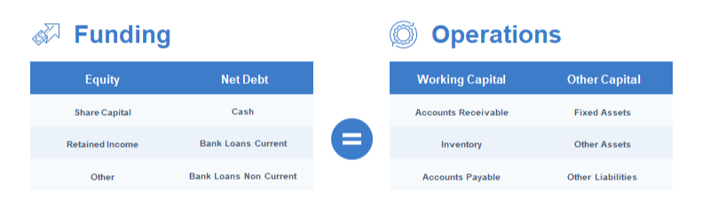

Your balance sheet lists all the assets, liabilities, and equity of your business - and it’s much easier to read than you might believe because it is actually just a simple equation.

This is how you read your balance sheet in one sentence:

Your funding must equal your operations.

Funding (Debt +Equity) = Operations (Working Capital + Other Capital)

That’s a balancing equation. It always has to balance.

#4 Your Management Team Is Accountable For Working Capital and Profit

Within that balance sheet, your management is responsible for 3 items:

- Your Accounts Receivable - How quickly people pay you

- Your Inventory - Or your Work in Progress

- Your Accounts Payable - How quickly you pay your suppliers

These 3 items make up your Working Capital.

Every month or every quarter - or whatever rhythm works for your business - your management team should be watching these items and asking the following questions:

What can we do to collect more efficiently?

Can we educate our customers how to pay us?

Can we prebill some of the work?

Is there any way we can reduce our inventory?

Can we renegotiate terms with our suppliers?

Your management team is also responsible for the company’s Profit.

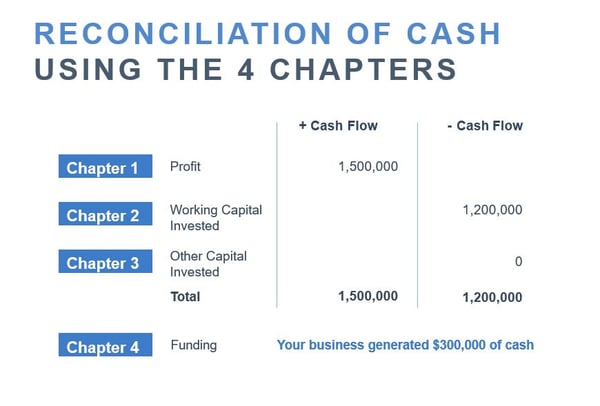

Therefore, the senior team is accountable for the first 2 Chapters of the Cash Flow Story framework (Chapter 1: Profit and Chapter 2: Working Capital).

What is the Cash Flow Story?

The Cash Flow Story is a clear framework for understanding how money moves throughout your organization. This clear look is essential for figuring out the quality of your cash flow and where to improve.

The four chapters are:

Chapter 1: Profit

Chapter 2: Working Capital

Chapter 3: Other Capital

Chapter 4: Cash Flow (or Funding)

There needs to be complete visibility around your numbers.

This level of transparency is needed, because it will make your CEO’s accountability much easier.

#5 The CEO Is Accountable For The Result Of The Business

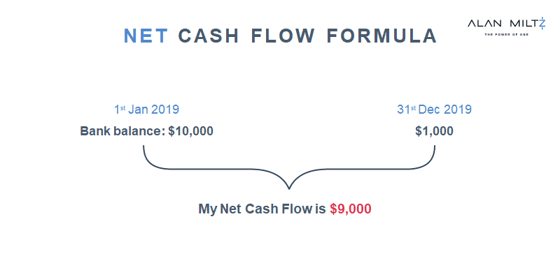

The result of your business is net cash flow, which is simply the change in all your bank accounts. (Cash - or funding - is the 4th and final Chapter of the Cash Flow Story.)

The CEO is responsible for this number.

One of the best CEOs I’ve ever worked with in my entire life is the previous CEO of a major bank in Singapore who managed to 10X that bank.

I was astounded at this accomplishment, so I asked him, “You are a brilliant leader. But an experienced banker. How did you do it?”

He said, “I always listen with empathy. I put myself in other people’s shoes.”

This is the key thing to remember if you want to know how to become a better CEO and scale your business faster on the cash flow side.

Even if you’re not a finance person, you can still be the L.E.A.D.E.R that knows how to play the game of business.

L – Listen (Notice how "listen" has the same letters as "silent". A good leader is the last person to talk in the room.)

E – Empathy, lead and listen with empathy

A – Always, always lead with a positive attitude

D – Decisions, know how to make tough decisions

E – Energize, know how to energize your company

R – Resilience (It's not how far you drop but how quickly as a leader you can bounce the company back.)

Listen to your management team with empathy. Show them that cash is the result of growth and management.

Then, get together with the team and workshop what changes your company can make to fix your company and your cash flow.

#6 To Win, You Have To Adjust - And Then Repeat, Repeat, Repeat

Remember: We are playing a game and the game is how to optimize your profit, cash flow and your value.

Your management team is responsible for the first 2 Chapters of your Cash Flow story (which are Chapter 1: Profit and Chapter 2: Working Capital).

Your CEO is responsible for the 4th and final Chapter of your Cash Flow Story (Chapter 4: Net Cash Flow, which is the result of the first 3 Chapters).

You must be disciplined about getting together with your team on a quarterly or monthly basis to figure out what are the changes you can make to improve your cash flow.

The Power of One tool that my partners and I developed will help guide these meetings, so you can focus on the best financial decisions to make.

(You can download your own copy of the Power of One Tool here.)

Build this habit with your team of telling your financial story over and over, so you can really understand how to scale up your company.

Focus On What You and Your Team Can Control

Never before has cash flow been more important for your business.

If you want to stay on top of it - and be prepared for any calamity that could impact your business - you need to become a financial storyteller.

What is the story that your cash flow is telling you about your business and what is the quality of your cash flow?

When you can tell this story, you can educate your team on which decisions truly impact your company’s value and then get into a habit of making those decisions.

That’s how you learn to love the numbers that help you drive business growth.