The #1 Cash Flow Strategy To Make Or Break Your Organization

While COVID-19 can’t infect companies, your business may still be experiencing negative symptoms that have taken hold and replicated uncontrollably.

The global pandemic response created an extremely challenging atmosphere for companies, many of which experienced substantial revenue loss from being shut down for weeks and, in some cases, months.

Even if your company was fortunate to maintain a profit, you likely experienced cash flow problems.

It’s time to address the No.1 question on every business leader’s mind:

How can you get the cash your company needs to survive (and thrive), and implement systems that empower you to thrive under severe circumstances?

Game On—or Game Over?

Verne Harnish says it best:

“You can get by with decent people, decent strategy, and decent execution, but not a day without cash. If you run out of cash—it’s game over.”

Even with the global pandemic nearly behind us, cash is the key to business survival. You need actionable advice on managing and improving cash flow to help you return to a thriving financial position.

Here's how to face and overcome your cash flow crisis.

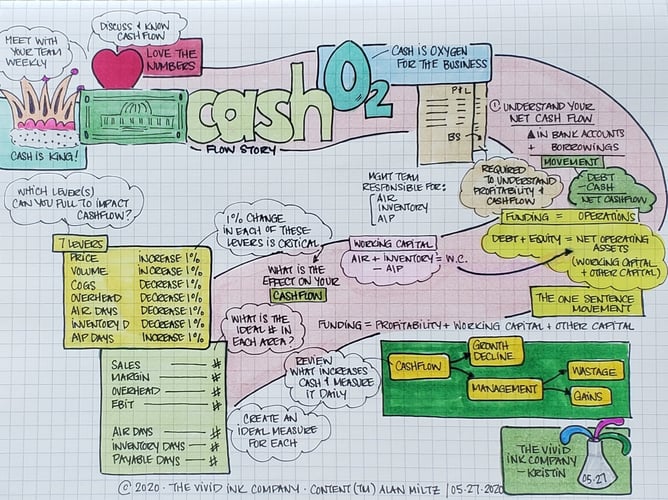

Visual summary by Kristin McLane of The Vivid Ink Company.

Follow her on Facebook and LinkedIn for more learning snapshots.

What’s the Most Important Indicator of Business Success?

Never before have your numbers been more critical than they are today. They tell the story of your business. As entrepreneurs, we like to talk about revenue, don’t we? Oh, how we love to discuss revenue! It’s a flashy indicator of how well your business is doing. But it is not the most credible measurement to determine a company’s success.

Too few business owners like to talk about profit or its often-overlooked cousin, cash flow. They are less obvious than revenue, and are often hidden on a balance sheet where they’re more difficult to understand.

Why You Must Make Your Business’ Numbers Simple and Easy to Understand

I’ve dedicated my whole life to making numbers simple. I’ve taken off my accounting shoes and put on the shoes of an entrepreneur. I’ve done this because I want to teach you to love your numbers.

Why do you need to love your numbers? As entrepreneurs, when we understand our numbers, we can improve them. Only when we understand and measure progress can we make improvements.

More importantly, you need to be able to teach your management team to understand and love your numbers, because they hold the key to improving your numbers so that your business will survive.

My goal is to make numbers easy. Here’s where we start.

“Revenue is vanity. Profit is sanity. Cash is king.”

Since we’re all missing live sporting events and games that were canceled by the pandemic, let’s think about cash flow as a game. We’re all competitive entrepreneurs who want to win that game, right? So how do you win?

You get the highest score.

What’s that score made of? How do you create the highest score?

The score is cash. Cash is king—and queen, for that matter.

Increasing cash flow increases your score in this competitive environment. That’s how you win. Now let’s examine the players.

When I walk into most companies, even the A-Players don’t know the score. They don’t understand the game and aren’t familiar with the rules that govern it, so they don’t know how to win.

That’s got to change, and I’m about to share the tools to help you change it.

What is cash flow?

Let’s start with the basics: What is cash flow, exactly? The accounting profession—yes, my profession—is guilty of making cash flow one of the most complex concepts around. So, I took it upon myself to create an easier way to explain it.

At its most basic, cash flow is simply the movement of money in all of your bank accounts in a given time period—that means everything that’s being transferred in and out of your accounts.

That includes the payments your company receives for goods and services as well as the payments you make to vendors, suppliers, and creditors.

Here’s an example: If you start the year with $10,000 in your bank account, and end the year with 1,000 in your bank account, your cash flow is -$9,000.

Cash flow is a performance measurement of the company’s CEO, and in that example, it’s an abysmal performance, down by 90%

Cash flow includes:·

- Cash balance in bank accounts

- Long-term debt, and any changes to that

- Short-term debt, and any changes to that

On a monthly basis, gather your team and do a quick calculation of your net cash flow by looking at changes to bank account balances plus—or minus—any loans or debts and the changes in the amounts you owe on them.

Your non-financial team members need to know the score of the game and how to improve it. The score is cash.

Teach them cash flow in a simple, non-threatening way and watch your cash flow position increase.

What is a Balance Sheet?

Most business owners I encounter can read a Profit and Loss (P&L) statement. Every single company I visit interprets a P&L in a consistent way. Unfortunately, it’s a harsh business truth that you can be profitable without having positive cash flow. Profit and cash flow are not the same things.

A question people seem to have trouble answering is: Why is there a gap between our profit and cash flow?

You will never understand the story of your business by only understanding its profit. Your balance sheet is equally important.

A balance sheet is a snapshot of your company’s assets and liabilities at any given moment in time.

The Balance Sheet, Simplified

Here’s how I explain a balance sheet in one sentence:

Your funding must equal your operations.

That’s about as simple as it gets, right? But it alludes to a lot of information about your business and its performance, so let’s unpack that sentence.

The amount of funding you have—made up of the equity you hold and the debts you owe—must equal the amount of money involved in your company’s operational side. That’s why it’s called a balance sheet; the two sides of the equation must balance equally.

When you add—or subtract—money on the funding side of the equation, it shows up on the operational side of the equation. Similarly, if you subtract—or add—money on the operational side of the equation, it shows up on the funding side of the equation.

The two sides of the balance sheet operate in tandem and are indelibly linked.

I repeat: Your funding must equal your operations.

Funding consists of two components:

- The equity you hold

- The debts you owe

Operations also consist of two components:

- Working capital, which is made up of payables, receivables, and inventory

- “Other,” which includes all of the complex terms that make us fear the balance sheet, such as the land and buildings you hold.

Of the two operational components on the balance sheet, the first—working capital—is in constant flux and can be improved through robust management by your management team. The second—what I call “Other”—doesn’t change as much and isn’t a factor in our current discussion about improving cash flow.

As a business owner, it’s critical to remember that your management team controls the three processes that make up working capital: payables, receivables, and inventory.

These three factors can be changed and improved, and therefore your working capital can be improved.

Let’s focus on these three processes that your management team controls.

3 Components of Working Capital That Your Management Team Controls

Your management team is in control of your company’s working capital, which is a result of:

1. Accounts receivable (How quickly we get paid)

2. Inventory (How much product or work in process we hold)

3. Accounts payable (How slowly we pay suppliers' invoices)

The manner in which your team controls them influences the efficiency of that working capital.

And the better your working capital’s efficiency, the better your cash flow—and the higher your score in the game.

How to Improve Working Capital Efficiency

There are four ways to improve the efficiency of your working capital:

- Send invoices faster

- Collect payments quicker

- Improve inventory management

- Negotiate longer payment terms with suppliers

When you explain these methods to your management team, they start to gain an understanding of their role in managing your company’s cash flow.

By focusing on the numbers consistently and sharing how your team’s behaviors affect these numbers, you’re educating your team on how to significantly impact cash flow—and, therefore, win the game.

The reason many companies are now suffering more than ever before is that they’ve never crowned cash flow king. It was always about profitability management.

But cash flow—not profitability--is the real factor you need to focus on.

Set up your War Room

We’ve established that we all want to win the game. And the game is about making more cash.

I recommend that all of my clients create a war room. The visitors to this war room should include your senior management team—representatives from operations, sales, marketing, and finance.

In this war room, display your financial metrics for all to see, discuss, and monitor. Transparency is the key. All of your management team members need to know how their decisions can alter your company’s profitability and working capital. Your management team needs to be held accountable for their actions in improving your working capital, and therefore your cash flow.

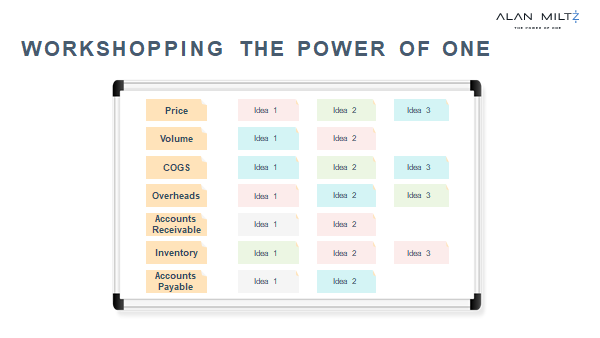

7 Levers For Controlling Profit, Cash Flow, and Business Value

There are 7 levers that your management team controls, with which they wield power over profit, cash flow, and business value.

The first four control your level of profit, the next three control working capital efficiency.

- Price

- Volume

- Cost of Goods

- Overhead

- Accounts Receivable Days

- Inventory/Work in Process

- Accounts Payable Days

In each monthly meeting, discuss each of The 7 Levers and the numbers associated with them in great detail, and ask your team for actionable ideas on what can be done to improve them.

In my monthly management meetings, we take a deep dive into each component of profit. We discuss our prices. Can we raise them? How much? Then we look at volume: Where can we make beneficial changes? We challenge our margins. We go through line by line to see where we can affect better management to improve our profit.

After that, we discuss our strategy for improving working capital.

We know our customers are paying us, but what can we do to improve the way we collect and how long it takes them to pay us? Can we invoice more frequently? Can we ask customers to pay us more quickly?

When we consider inventory, we note whether we’re holding too much and what changes we can enact to hold less without negative consequences to our business model. Then, we consider whether we can go to our suppliers and renegotiate payment terms—say, increasing our days to pay from 30 to 45, 60, or even 90 days.

Your management team needs to understand all of the ways their daily actions and decisions impact your company’s overall cash flow.

Teach Your Management Team to Play the Game Strategically

Your management team makes decisions on behalf of the company each day. When you teach them to play the game better, they will create gains for you. As they develop an understanding of The 7 Levers they control to boost profit and working capital, every time they make a decision, they’ll consider how it impacts cash flow.

Your management team is responsible for profit and working capital.

To that end, constantly reiterate the following:

- Increased prices, good for cash flow.

- Decreased margins, bad for cash flow.

- Collecting slower, bad for cash flow.

- Paying slower, good for cash flow.

- Increasing overhead, bad for cash flow.

Teach people to do their job better by giving them the parameters for winning the cash flow game. The members of your management team are competitive and want to help the business do well.

When you remind them that your company’s cash flow is the result of growth and good management, they’ll start to create gains.

What is the Power of One?

Small, incremental changes to each of The 7 Levers can have a profound effect on your business over time. I call this The Power of One, a reference to the power of even a one percent change to any of The 7 Levers on your cash flow position.

Every company has gaps that can be minimized. In every meeting, ask your team: What gap do we need to fix in our company?

Here are some potential gaps that may need fixing:

- 2.5% gap in margins and profit

- 16-day gap in receivables

- 28-day gap in inventory

A simple one percent change to any one of these metrics alone would provide your business with more cash.

Each month, ask your team to each come up with actionable ideas for how to improve each of The 7 Levers by one percent—or more.

Have them write their suggestions down on sticky notes, and display them for all to see.

Then, consider which two or three of these ideas you’ll implement that month to improve your working capital efficiency and cash position.

That’s the Power of One.

My company makes software that demonstrates how the Power of One can impact your company—how just small, incremental changes can have a powerful effect.

Leverage the Power of One in Your Business

The Power of One is the portal through which you fix your cash flow problem.

It provides an interactive way to show your management team in real time how increasing prices by just one percent—or lowering overhead by five percent—will improve cash flow and operating profit. Use it to inspire your team to brainstorm new ways of enacting small, incremental changes that add up to a big impact on the bottom line.

You can download your own Power of One worksheet and work through it here.

When you consistently lead honest, transparent, strategic discussions with your management team, the Power of One becomes your company’s DNA. Your team begins to understand how every decision they make and action they take impacts your company and its cash flow position.

Each month, enact one or two valuable Power of One changes.

For example, maybe this month you’ll choose to raise prices by two percent and make a 7-day improvement in collections.

Over time, these incremental changes have a significant effect on building cash flow and transforming your company. That’s how you change the score. Decide which changes to make, show the team how their actions and decisions translate to improved cash flow, and the score will start to improve.

Cash flow is the result of growth and robust management.

Never has it been more fundamental for your management team to know the score. The score is cash!

When you help your management team understand and love your numbers by presenting them in simple terms that are easy to comprehend, your A-Players will take the ball and score repeatedly with ongoing cash flow improvements—and that’s how you win the game!