How To Manage Your Company's Cash, Profit & Value (Even If You're Not A Financial Expert)

In 2016, I witnessed the greatest sporting upset in living memory.

For those of you who follow soccer, it was when Leicester City won the English Premier League. The odds for Leicester City winning were only slightly higher than Kim Kardashian becoming the president of the USA.

So, how did Leicester City win?

It's because everyone on their team knew how to play the game. Each player understood the 1% changes they needed to make.

Every single business I ever visit discusses with me their profit. That's a quarter of your story. The result of your story is your cash. The reason you're reading this is because you want to make more of it.

In this article, I’ll give you techniques that will help everyone in your company become Leicester City and win your Premier League. To illustrate this, I’ll use a real example: Milok Group, a real business (though the name has been changed) that imports and distributes hair care products.

Understand Your Four Chapter Story

Technique number one: What is your cash flow?

If you start the year with $10,000 in your bank and you end it with $1,000 left in your bank, you will likely tell me, "My cash flow is minus $9,000."

Cash flow is the change in all your bank accounts. So in other words, every week, month and quarter, I look at my numbers in my bank accounts.

Your business is like reading a murder mystery.

Imagine reading chapter one of a murder mystery. You'll never know who committed the crime. It’s no different with our financial story, we read chapter one and wonder why we don't know what happens. You need to understand the whole picture, all Four Chapters.

Chapter One: Profit

Chapter Two: Working Capital

Chapter Three: Other Capital

Chapter Four: Net Cash Flow (which is the result of the previous three chapters)

Reading Your Balance Sheet

The Four Chapters tell the story of your numbers.

But you will never become a storyteller if you don’t understand - like Leicester City - how to play this game better. And by “you” I mean everyone on your management team.

You need to understand the rest of the story on your balance sheet. Accounting has made the balance sheet very complex and full of technical terms. The reality is that the balance sheet is a mathematical equation. It's simple arithmetic.

9 + 5 = 8 + 6

And the simple equation is:

Funding = Operations

Chapter Three And Your Management Team

On that balance sheet, your management team is only responsible for three numbers which are called your Working Capital (Chapter Two).

In every single meeting, I want your team to understand these three key numbers:

- Accounts receivable,

- Inventory, (in a service company it's called Work in Progress)

- Accounts payable

Your management team needs to understand everything that impacts these numbers. Are we collecting properly? Are we managing the inventory, or are we invoicing the work we do frequently enough? And do we have the right terms with the suppliers?

Here again on the balance sheet we see these numbers that Milok’s management team is responsible for in 2019: receivables, inventory, and payables. %20(1).jpg?width=864&name=milok%20groups%20financial%20statement-1%20(1)%20(1).jpg)

Milok has $7.7 million invested in their operations in 2019 (Short Term Debt + Long Term Debt + Equity - Cash).

Their working capital is $4.7 million (Accounts Receivable + Inventory - Accounts Payable). So, of the $7.7 million, their management team needs to understand the $4.7 million they control.

The equation has to add up. It's a pure mathematical equation. Everything that's not working capital - which is what I call the “baggage” in a balance sheet, the difficult stuff to understand - I just call Other Capital.

In Milok's company, the other capital is a $3 million investment in a warehouse.

Your Four Chapter Team

Now that your management team understands which items they are responsible for, it’s time to get to work and gamify your business.

You are playing the game to get more cash. So, how do you do it? You’ve got to teach your team to play the game of better profit and improved working capital.

There are only seven variables your management team can do to play this game.

- Price

- Volume

- Margins

- Overhead

- Receivables

- Inventory (or work in progress) and

- Payables

When you present to the management team, don’t have the accountant talking to them in jargon. It needs to be for the benefit of everyone sitting around the room who's never learned how to read numbers.

Listen to them with empathy. We need to take off our shoes when we talk to our non-financial people and put on the shoes of someone who wants to understand the game but to whom the game has never been properly explained.

The conversation should be around, "We need to make more cash." You do it by having a discussion on a monthly or a quarterly basis around these seven levers above.

Chapter One is your profit. Every one of us around the world understands profit. In our example from above, Milok says, "I'm ecstatic. I made 1.5 million."

This is where I would then say, “The result of your company is cash.” The quick and easy way to calculate cash is to track the change in all your bank accounts. For Milok, that’s $300,000.

But Milok won’t get the full picture if they look at just their net cash flow (Chapter Four) and their profit (Chapter One). What happened in Chapter Two?

(I analyzed Milok Group’s numbers more in-depth during our recent webinar. Watch it here if you want to look deeper.)

If you adopt the Four Chapters, your interpretation is very different to Miloks' interpretation. Their profit was great, but they’ve got poor working capital and nothing happened in Chapter Three. They haven’t made enough cash.

The conversation then should be all about improvement. Your management team is responsible for your profit and your working capital excellence. They’ve got a critical role to play in taking control of your numbers.

I call it the Four Chapter Team. Everyone - your sales, marketing, operational people, etc. - are all part of the solution. You’re still going to have monthly, quarterly meetings, and wonderful discussions around people, strategy, and execution.

But you also need to have discussions around price, volume, margins, overheads, receivables, inventory, and payables.

Verne Harnish always says that one of the traits of a great leader is to repeat, repeat, repeat. We need to repeat, repeat, repeat during every single meeting.

In the end, everyone on your team needs to say of every new transaction, “What can I do with these levers to make a better decision?”

Know Your Big 3 Cash Flow Measures

There are three critical cash flow measures:

- Net Cash Flow

- Operating Cash Flow

- Marginal Cash Flow

The CEO is responsible for the first of these, Net Cash Flow, which is the change in all the bank accounts.

You can also define it as the result of the previous three Chapters. You have Chapter One: Profit, Chapter Two: Working Capital, Chapter Three: Other Capital. Together, they give you Chapter Four: Net Cash Flow. That's the reconciliation.

Your management team is responsible for the first two chapters: your profit and your working capital (which feed into Operating Cash Flow). The management team has seven levers in their armory.

Cash flow is the result of growth or decline and management. When you grow, you need cash. When you decline, there're cash flow implications. If you don't teach this to your management team, they will be going out every day making decisions that are either going to be a waste or gain in terms of cash flow excellence.

Your management team likely knows what happens when you raise prices, improve margins, or collect faster. They know if it’s good or bad for cash. But you still need to show them this impact. Every single month I show my teams what's changed.

Repeat, repeat, repeat. Do this over and over again and see how quickly your management team changes the way they look at a transaction or an opportunity.

So, how do you actually show your management team (who are non-financial experts) what success looks like?

Leverage Your Power of One

What I'm going to tell you now can become life-changing to your business.

There are only seven variables your company can do to achieve financial excellence. And as I said above, your management team controls these levers: price, volume, cost of goods (or margins), overheads, receivables, inventory (or WIP), and payables.

This simple rule has become the basis of my work over the last 20 years. How can you create something that's so simple that can change every business? Every company has its own DNA and we created a technique to read it. We call it the Power of One.

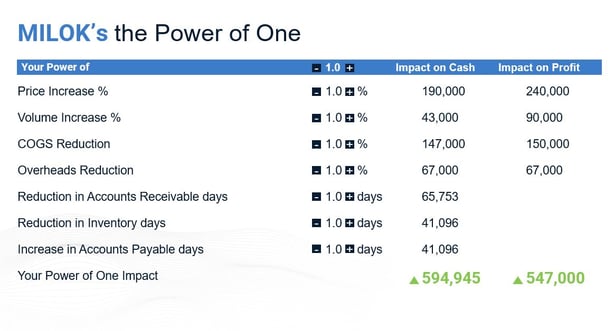

Let’s look now at Milok’s Power of One example. What do their 1% (or one day changes) do to their cash and profit? Their cash flow is currently 300,000. Do you realiz

e that if all they change is 1% in the business, their company will improve its cash by 594,000 and profit by 547,000?

Whenever I look at the Power Of One, I straight away look at certain relationships, like price to volume.

In Milok's company, price is five times the sensitivity of volume to cash. How can you allow your salespeople to operate on their own when they don't know this relationship? Put prices up by 2%, lose 5% in volume, and you're better off from a cash and a profit perspective.

Everyone on your management team needs to understand the power of one every single day of their lives. These relationships need to be toggling through their brains so they can work out what they can possibly change.

The Power of One Workshop

Every quarter, I run a Power of One workshop with my teams, and we work out the changes we can make in both these seven levers.

In the meeting I start by asking the team, “How many 1% changes can you make in your business?”

I'll then put seven levers down the side of a board, and I will give sticky notes to everyone in the room. That would be the sales, marketing, operation, and finance teams. And then we take it lever by lever and we workshop which products and services we can make price changes on. Then we come back to the board and we rank from most to least sensitive.

When we finish the session, we choose the top four or five ideas that get implemented.

It's the repetition of these changes that give you the business you've always dreamt of. The Power of One is your DNA. It is a non-financial tool which fixes everything.

Everyone in your business, whether they're in the warehouse or they're on the sales team will understand the Power of One and they can play a better game. The numbers belong to everyone. My absolute mission in life is to make every company understand the game and how to play it better.

Run Projections & Stress Testing (Example)

Over the past few years I've taken the Power of One to a more micro opportunity. Here’s an example.

A footwear chain in the UK recently approached me.

The owner of the company says, "Everyone thinks we make money. We've got 120 stores," and I said to the owner, "Tell me about your profit."

He said, "I made 800,000 profit last year, and I sold 800,000 pairs of shoes."

I said, "You made a dollar a pair?" He said, "Yes."

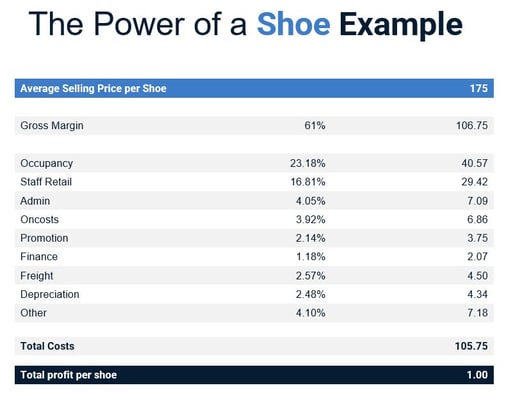

I said, "Good. Call in the designers, the production, the operational people into a room, and I'm going to teach them the power of a shoe." We sold hundreds of styles. The average selling price is 175. Everyone knew our margin (61%, $106) and that's why they thought we made so much money.

Then I showed them. Occupancy costs were 23%, $40 a pair. Staff retail wages were 16%, $29 a pair. Admin cost was coming to $105. For the first time the company finally understood why they weren't making money.

I said to the team, "I'm coming back in two weeks." Give me a strategy to make $5 per pair."

The team looked at each one of the inputs and made a plan.

Within six months, we were up to $5/pair.

Conclusion

The one thing that you can never lie about is cash flow.

It’s the only number in your business that's absolutely true. It’s the movement in all your bank accounts. You can manipulate your profit which your cash flows affect. But your profit is an opinion. Your cash is a fact.

Remember: Revenue is vanity, profit is sanity, cash is king!