7 Ways To Easily Bring In Cash For Your Business

As you grow your company, you’ll figure out what every entrepreneur eventually discovers: Growth sucks cash.

When you scale you take on new systems and processes that quickly eat at your financials and fill up your balance sheets.

This increase can become your business’ undoing if you’re not careful. Yes, your profits and revenue may show healthy financial growth. But those numbers increased because you took on more expenses. They don’t reflect the financial reality of your business.

If you want to grow, make sure you have access to the cash that fuels that growth.

That’s why you need to understand and be constantly tracking how cash flows in and out of your company. When you and your team learn to love the numbers and managing your financials becomes simple.

You can do this with a tool that I like to call the Power of One.

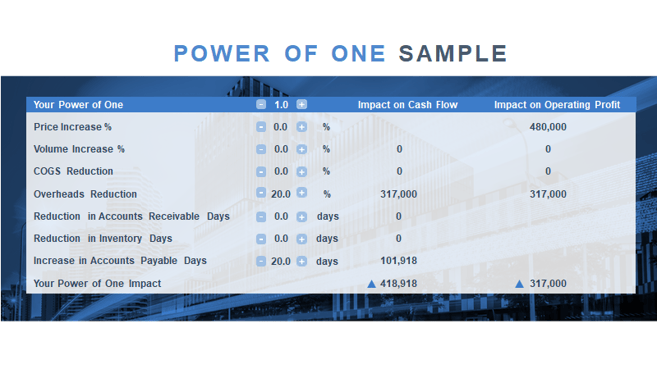

The Power of One is based on a simple concept that helps you manage your critical business numbers without getting overwhelmed. It relies on the idea that even a few 1% or 1-day changes to your operations can dramatically impact your cash flow and push you to financial excellence.

With the Power of One, you and your leadership team will be able to manage your numbers with simplicity, so you have more time to focus on the business.

So, how do you put the Power of One to work?

First, let’s understand what makes cash so critical to your business.

Why Cash Flow Is The #1 Measurement In Your Business

I spend decades working with entrepreneurs to evaluate their businesses. And what I’ve seen proven true time and time again is this:

As the business, we speak Spanish, and our bank speaks Portuguese.

The owner talks about profit, but the bank is looking at a different number.

What the bank really wants to know is if you have future cash flow to fund your interest and your maturing debt.

That’s the situation that I see often playing out.

As a business owner, you may be fixated on your profit numbers. But I’m here to tell you that your profit is an opinion. You can easily change the data on your balance sheets.

It’s cash flow - not revenue or profit - that is the ultimate indicator of how your business is performing financially.

If you’re going to grow and stay ahead of your expenses, you need to understand the language of numbers from both the viewpoint of the business and of the bank.

I’ve created a simple framework that helps you easily understand your financial situation called the Four Chapters. This 4-part framework helps you answer the question:

What is the quality of our cash?

Once you understand the Four Chapters of your financial story, you are ready to make dramatic changes with the Power of One tool.

Your Company Financials Told In Four Chapters

The result of your business is cash flow. It is the movement in all your bank exposures (your borrowings + your cash in the bank).

You cannot understand cash flow by looking at just profit. Instead, you look at all the inputs.

These inputs feed into the four chapters of the financial story of your company.

The four chapters are:

Chapter 1: Profit

This one is pretty simple. Just about every business understands their profitability.

Chapter 2: Working Capital

This is equally important to your profit. Working capital is a measure of your collections, your receivables, your inventory, how you pay your suppliers, etc.

Chapter 3: Other Capital

If you’ve invested in additional infrastructure - like land, buildings, and other complex holdings - those numbers go here.

Otherwise, you don’t need to spend much time on this chapter.

Chapter 4: Funding (of Cash)

This is the result of the first 3 chapters.

Here, you understand whether you generated cash or require funding.

Interpreting Your Four Chapter Story

Cash flow is the result of growth (Chapter 1 Profit) and management (Chapter 2 Working Capital and Chapter 3 Other Capital).

Your cash flow helps you understand whether management is doing a good job or a bad job.

Every time you make a change in the way in which you run (manage) your company, there is an impact on cash.

The Power of One tool helps you understand which management decisions will positively impact your cash flow.

There are 7 Levers within the Power of One.

Every time you change one of these Levers (collect slower, grow your overheads too quickly, etc.) you impact your cash flow.

Cash is then the result of growth plus the changes in the Power of One (management).

Now that we have mapped your 4 chapters and seen your cash flow, we move on to the big question:

How do we fix your company?

This is where you are ready to apply the Power of One tool.

Use The Power of One To Improve Cash Flow

As the CEO or executive leader, you are responsible for operating cash flow.

If you understand the dynamics of your financial story, you can work out what decisions you need to make to have a positive impact.

There are 7 main financial Levers in your business that you and your team can adjust by just 1% to improve your cash flow. The 7 Levers you can tweak are:

- Price. You can increase the price of your services or products.

- Volume. You can sell more of the product/service that you provide.

- Cost of goods sold (COGS)/direct costs. You can lower the price you pay for your raw materials and labor. If you can focus on lean initiatives in your process, you can get your costs down.

- Operating expenses. You can reduce your operating costs. Reducing sales cycles using Victoria Medvec’s negotiation tools.

- Accounts receivable. You can reduce your debtor days. The question here is, Can you get your customers to pay you quicker?

- Inventory/work in progress. You can lower the amount of stock or inventory you have on hand. Just upping your utilization rate can be helpful.

- Accounts payable. You can extend the time in which you pay your creditors. If you’re a great customer and you are consistent, they will likely cut you some slack and you can come to an agreement.

Just a 1% change to any of these Levers can dramatically increase your cash flow if you know which lever will have the most impact.

Once you understand that, you can create a plan that focuses on adjusting the right levers.

You can download your own copy of The Power of One Tool here.

You'll need to know your Net Cash Flow ($) and your EBIT ($) to get started. Fill those numbers in and then you can start to play around with the 7 levers.

How To Implement The Power of One With Your Team

Making the Power of One work for your business is all about figuring out what you need to change to achieve financial excellence.

I recommend having at least these 3 steps in place.

- Make sure that your management team understands the Four Chapters of your business.

- Create a monthly or quarterly financial scorecard of your Four Chapters. Set targets on this scorecard and review regularly with your team and staff.

- Show your management team the Power of One and have a discussion on the worksheet to identify which of the 7 levers you will adjust.

The big question of this discussion will be: How many 1% or 1 day changes do we need to make in the business to achieve our desired cash and profit?

Get Your Company On The Path To Financial Excellence

As the executive leader, you are responsible for understanding your numbers and how your decisions affect them. It's up to you to learn the movement of your cash flow and share that knowledge with your team.

That's why I so strongly recommend the Power of One for you and your management team.

It’s my belief that this tool is the code of your company. It won't just improve your cash and profit. It will set your team on a path to financial excellence by helping you learn to love the numbers.

Remember:

"Revenue Is Vanity, Profit Is Sanity, Cash Is King or Queen!"