Take These 4 Time-Saving Steps To Improve Your Business Finances

The business climate shifts from year to year, with everything from politics to pandemics changing the way companies work.

But through it all, business leaders continue to face key challenges around capital and cash flow.

Annual surveys from small business funder Guidant Financial tell the story.

The organization’s polls have consistently shown financial issues are among business owners’ greatest concerns, with 23% naming capital and cash flow their biggest challenge outside of COVID.

To help you tackle your business’ financial challenges, you need a simple process for converting your numbers into a story everyone understands. That’s because entrepreneurs, CEOs, and other executive-level business leaders don’t have time to waste clearing up confusion about which figures to focus on and what language to speak in sharing them.

After all, what did 14% of business owners who Guidant Financial surveyed say was their greatest concern? Time management.

4 Time-Efficient Steps To Manage Your Business’ Finances

If you want to improve your organization’s finances (while also navigating time management concerns), you need straightforward steps that help you and your team love and understand your numbers.

When you understand your numbers, you can accurately measure your progress and improve your finances.

The following 4 steps can help ensure your business is strong in the financial areas that show stability and growth. And they’ll save you time by simplifying the way you approach money management.

1. Manage Your Cash Flow

I’ve spent most of my adult life working to simplify numbers for people, companies, and banks all over the world. One trend that sticks out among entrepreneurs I’ve encountered is this: Too often, they focus on revenue and profit and ignore the most important number: cash.

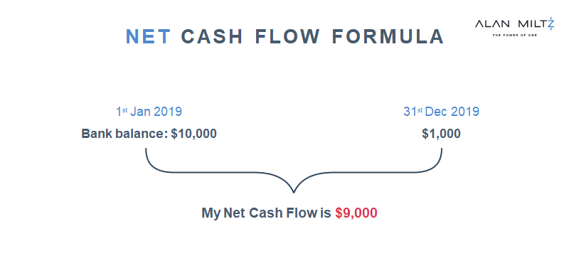

Cash flow is the movement of money in all your business’ bank accounts in a given time period, or everything transferring in and out of your accounts. It includes payments your company receives for products and services as well as the payments it makes to vendors, suppliers, and creditors.

Let’s say, for example, you start the year with $10,000 in the bank and end it with $1,000 left in your bank. Your cash flow is -$9,000.

Every week, month, and quarter, look at the numbers in your bank accounts.

Profit and revenue comprise the inputs of your business’ financial story. But the bank is interested in your organization’s capacity to repay its debt. And when you operate a business, you need cash to fund its growth. These situations represent cash flow, the most critical aspect of your business’ financial health.

That’s why my favorite saying is: Revenue is vanity. Profit is sanity. Cash is king (or Queen)!

2. Speak Your Bank’s Language

Another observation I’ve made in my quest to help companies love their numbers is that, too often, businesses and banks speak different languages.

It’s as if entrepreneurs speak Spanish, and the bank speaks Portuguese.

How do you get your bank to love you? Speak its language.

Arm yourself with information about your company’s cash flow numbers when you communicate with your bank. Remember, your business may have had a stellar year profit-wise—but simply sharing that number doesn’t tell the story of cash flow. And cash flow is the bank’s main interest.

In fact, the bank knows your cash flow numbers every day because it wants to ensure that the company has the cash to repay what it borrowed, along with interest.

Put on the shoes of your bank, consider its priorities, and remember that revenue and profit are important numbers—but they’re not the most important numbers, and they’re certainly not the bank’s focus.

3. Make 1% Changes To Your Rates

A simple 1% or 1-day change to rates can improve your cash flow. You can make these 1% adjustments in any of the following 7 areas:

- Price. Increase the price of your products or services.

- Volume. Sell more of the product or service you provide.

- Cost of goods sold (COGS)/direct costs. Lower the price you pay for raw materials and labor by focusing on lean initiatives.

- Operating expenses. Lower operating costs, and reduce sales cycles using Victoria Medvec’s negotiation tools.

- Accounts receivable. Reduce the amount of time it takes for customers to pay.

- Inventory/work in progress. Lower the amount of inventory your business has on hand.

- Accounts payable. Seek to extend the time by which you pay your creditors.

In which of these areas will 1% changes have the most dramatic impact on your company’s cash flow?

You can find out with my Power of One Tool. Just plug in your numbers and the tool will reveal your best areas of opportunity.

4. Plan Ahead With Your Team

Now you’re focusing on cash flow, speaking the language of your bank, and finding levers for making small adjustments.

So, what’s next?

Commit to meeting regularly—weekly, monthly, or quarterly—with your team to evaluate your progress and determine what changes you can make to improve your cash flow.

Focus on what I call the Four Chapters of your Cash Flow Story:

Chapter 1: Profit, or generating revenue over expenses

Chapter 2: Working Capital, or a measure of figures such as your collections, receivables, inventory, and how you pay suppliers

Chapter 3: Investments in additional infrastructure such as land and buildings

Chapter 4: Funding Of Cash, or the result of the first 3 chapters

Now that everyone loves and understands the numbers, they can see how they fit into the big picture for your company.

Verne Harnish’s One-Page Strategic Plan can help you communicate your vision and action-oriented strategic plan to align every employee in your company.

Use this tool to help you track whether you’re progressing toward your goals. Be prepared to share that information with your board as part of your discussion of strategy, people, and finances.

Manage Your Cash, Profit, And Value

You’re on your way to getting control of your business finances—and saving time in doing so. You’ve got the tools to help you and your team love and understand the numbers that measure business success.

Now I hope you’ll explore the opportunity to take a deeper dive and discover how to tackle your cash and time challenges all at once.